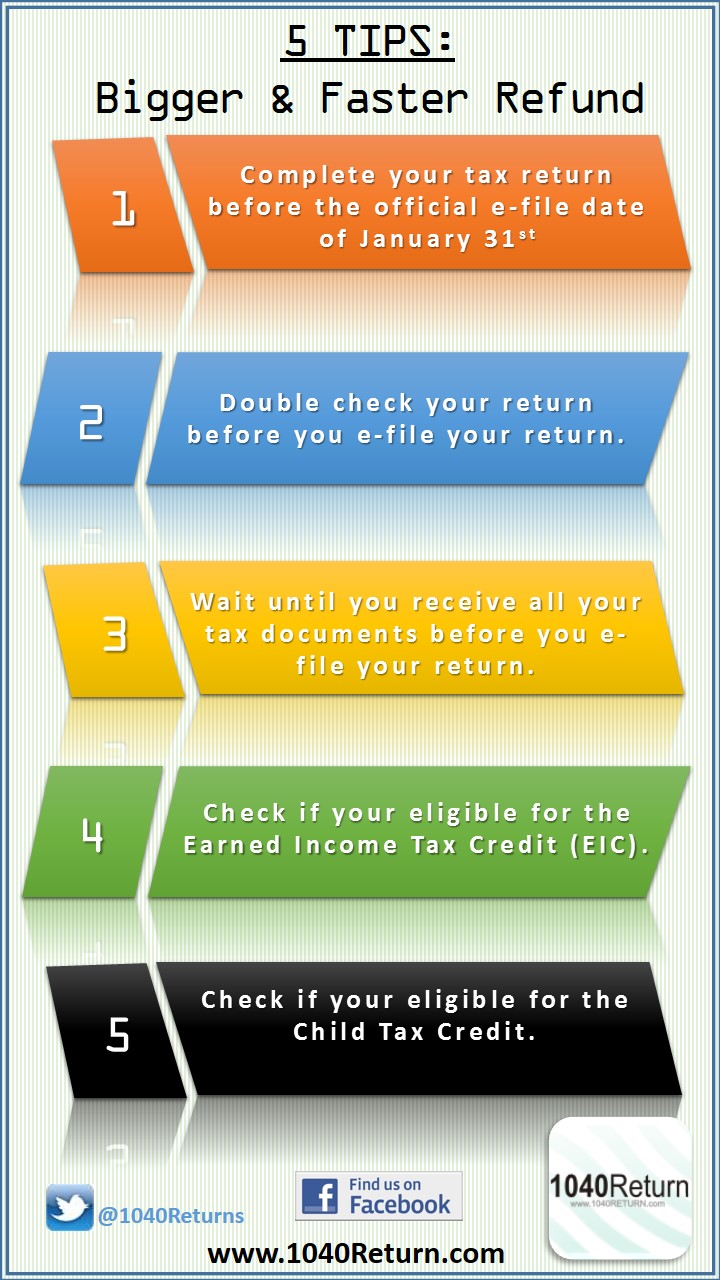

If you are expecting to receive a refund, here are a few tips on how to get a quicker refund and how to make sure your taking full advantage of your tax credits and deductions.

1. Start and complete your tax return on 1040Return before the official e-file date of January 31st.

The IRS will be accepting returns on January 31st. Most people will fall into the trap that they should start their return on January 31st and e-file their return on or after the 31st.

However, if you e-file your return on the 31st of January, there will be a couple of million returns ahead of your return before the IRS even start to process your return.

The solution is to start your return ASAP. 1040Return’s program will be available on January 13th and this means you can start working on your federal tax return for only $4.95. Once you are completely satisfied, go ahead and submit your return to 1040Return. If you submit your return to us by January 20th, we will hold your return and release it to the IRS on January 31st at 12:01 am. This means your return will be first in the queue to be processed by the IRS.

In the past, the IRS actually started accepting e-file returns in a limited number before the 31st to test their system. So, if we receive your return before the 31st we could possible transmit your return to the IRS before January 31st. Which means you could receive your tax refund by February 8th.

2. Double check all Social Security numbers and Birth dates before you e-file your return on 1040Return

One of the biggest reasons why people’s tax returns are delayed is because of incorrect Social Security numbers and incorrect Birth Dates. When you input the wrong Social Security Number or Date of Birth, your return will be rejected and you will have to make the necessary corrections and resubmit your tax return again to the IRS.

Make sure that the Social Security number and the name is exactly what appears on the Social Security Card. The IRS will match the data that you provide with the Social Security Administration.

One common problem is with individuals that they have 4 names. Such as “John Evans Butler Smith” with “Evans Butler” being the middle name. The IRS sometimes will read “Butler” as the last name and reject the return because you have “Smith” listed as the last name. So, if that happens, just change “Smith” as the last name to “Butler” on your tax return and resubmit. The bottom line, always list the name exactly as you did last year, provides your return was accepted by the IRS.

3. Wait until you receive all of your W-2s and tax documents before you efile on 1040Return

Sometimes people get impatient and submit their tax return before they receive all of their W-2s or 1099s. Remember, all employers and financial institutions have until January 31st to mail out W-2s and 1099s. Some people efile before they have these documents, and they short change their refund.

If you do not file all of your W-2s or 1099s, you will have to file a 1040X to add the additional documents. This creates extra work! Plus, the additional refund that you receive from the 1040X will take an additional 8 weeks.

If you do not receive your W-2 or 1099 by January 31st, you have to wait until February 15th when you can submit a substitute W-2 or 1099. The IRS will not accept a substitute W-2 or 1099 until that time. When you do file a substitute W-2 or 1099, use the last paystub or statement to calculate your income.

4. Take advantage of the Earned Income Tax Credit, if eligible

Earned Income Tax Credit “EIC” is one of the most popular tax credits. If you have children, and make under a certain amount, the government will actually give you money.

For example if you have three children, file as Head of Household, and earned $14,300.00 last year, the government will give you an additional $6,044!

Like all tax laws there are certain requirements. Here are the major rules and like all rules there are exceptions.

a. Meet the relationship test – in another words the child must be related by blood.

b. Age Test – the child must be under age 19 or going to college and between 19 and 24.

c. Your home must have been in the United States for more than half the year with the child living with you.

d. All filing status qualify for the Earned Income Credit except married filing separately.

e. The income must be earned – in another words W-2 wages, unemployment insurance does not count towards “EIC”.

This is a brief over view on the Earned Income Tax Credit for a more in depth discussion click here.

5. Check your eligibility on 1040Return to see if you can receive the Child Tax Credit

This is another great credit and is refundable to the extent of 15% of earned income in excess of $3,000.00. Below is how this credit is calculated

For Example: Jane has one child, John that qualifies for the child tax credit. During 2013, Jane’s income is $10,000. Her credit is the lesser of $1,050

Here are the rules to receive the Child Tax Credit.

a. Must be related by blood.

b. Must be younger than 17 at end of the year

c. Must not have provided more than half of his or her own support

d. Must live with you more than half the year

e. Must be a US citizen.

So, with these 5 simple tips, you can increase the speed and amount of your refund when you e-file.

For additional tax tips sign up for our Free Tax Newsletter.