Last year’s Tax Cuts and Jobs Act (TCJA) is confusing to many taxpayers when it comes to home equity loans. This act changed the rules on whether the interest on these loans is deductible. So is it?

The short answer: Not unless you’ve used the money to buy, build or substantially improve your home.

The IRS indebtedness rules

For decades, taxpayers have been using home equity loans to finance home improvements, borrowing against the value of their home. But they’ve also used home equity loans and lines of credit for alternative purposes, such as paying off credit card debt, paying for big purchases, or simply to finance living expenses.

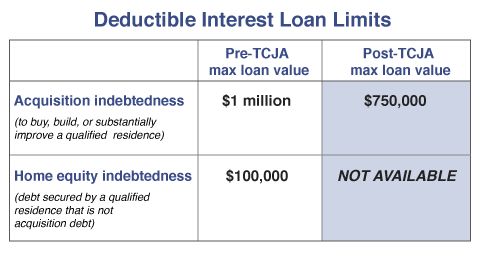

The government removed these alternative purposes from the tax code beginning in 2018. Before the change, you could deduct interest on up to $100,000 in home equity indebtedness not spent on your home. Now, the interest is deductible only if it is used to buy, build or substantially improve your home. The IRS calls this acquisition indebtedness.

Example: Sam got into trouble with his credit cards in 2015 and took out a $100,000 home equity loan to consolidate his debts. It lowered his annual interest rate to 6 percent from 12 percent and he was able to deduct $6,000 in interest every year as an itemized deduction. Starting in 2018, Sam will no longer be able to deduct those interest payments. Sam did not use the loan to build, buy or substantially improve his home.

What you need to know

- Lower debt limits. The limits on the amount of acquisition indebtedness for deducting interest drops to $750,000 from $1 million. This lower limit only applies to new loans incurred after Dec. 15, 2017.

- Less deductible interest. All interest on home equity loans and lines of credit used for anything other than to buy, build or substantially improve your home is no longer deductible.

- Enforcement challenge. It’s anyone’s guess how the IRS will enforce this rule. Your best bet is to keep any receipts for home improvements for the year. Then, figure out ways to apply outstanding loan balances to home improvements.

- Don’t confuse terminology. Try not to get confused by the terms the IRS uses and what your bank may use to refer to your loan. The IRS doesn’t care whether the bank calls the loan a home equity loan or something else; it only cares how you use the funds.

Once you’ve filed your 2017 taxes, consider scheduling a planning meeting to discuss the many tax changes new this year.