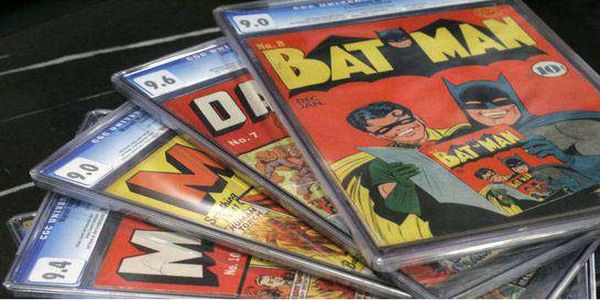

It typically takes a great deal of personal interest and expertise in a given field — whether it’s rare art, coins or baseball cards — to judge a treasure from a trinket. For those of you who have been bitten by the collector’s bug, here are some tax considerations for your collectibles.

Collectibles defined

Collectibles defined

According to the IRS: “Collectibles include works of art, rugs, antiques, metals (such as gold, silver, and platinum bullion), gems, stamps, coins, alcoholic beverages, and certain other tangible properties.” 1 What makes something a collectible is that it carries additional value based on its rarity and its market demand. Essentially, the opinion of other collectors and experts, based on what they are willing to pay for your collection, determines its value.

Collectible Coins

For example, a typical one-ounce gold coin is worth about $1,200 based upon the value of the metal and would not be considered a collectible by the IRS. However, a rare antique double eagle gold coin produced in the 19th century could be worth $20,000 to a collector. Regardless of whether it is made of exactly the same amount of gold as the non-rare coin.

Collectibles special tax rate

Collectibles are taxable at a maximum tax rate of 28 percent when they are sold. The tax applies to profit on the sale of your collectibles.

That tax rate is considerably higher than the average capital gains tax of 15 percent that most people pay for non-collectible investments such as stocks and bonds (the tax range for long-term capital gains is from 0 to 20 percent). The exception to this rule is that if you’ve held your collection less than a year before you sell it, your capital gain will be taxed as regular income.

It’s all about the basis

In order to calculate what you owe to the IRS if you sell your collectibles, start with your basis. Your basis typically equals the amount you paid for your collectibles, plus any auction or broker fees incurred during your purchase. If you spent money to refurbish, restore or maintain collectibles while you owned them, you can also add that to your basis.

Then, subtract your basis from the sale price of your collectibles; the amount left over is what is taxed. Here’s an example:

Ima Dahl decides to sell an 1898 German Bisque porcelain doll from her collection. She paid $700 for it originally, ten years ago . Ima also paid $150 two years ago to repair its cracked finish. She receives $1,800 by selling at an online auction and spends $100 paying in auction fees and shipping. Since she owned the doll for over one year, her capital gain is $850 and her potential maximum tax is $238. The calculation: $1,800 net sales price, minus the $700 basis, minus $150 for repairs, minus $100 selling expense multiplied by 28%.

Some collectible hints

- Know the market value. If you inherit a collectible you will need to know the value of the object on the date you obtain it. This will usually become your basis when you sell it.

- Investment or personal use. If your collectible is an investment you can usually take a loss on the sale of the collectible. Unfortunately, if the IRS deems the collectible has an element of personal use, you may not deduct the loss. An example of personal use may be the hanging of a painting on your wall. Being careful how you sell your collectible can also make a difference in managing your potential tax liability.

- Collectibles tax rate good or bad. The 28 percent capital gain tax on collectibles is the maximum tax rate. For example, if you are in the 15 percent income tax range, your collectible gain is taxed at that rate. If your income tax bracket is higher than 28 percent, the collectibles tax rate is capped at 28 percent. This results in a potentially lower tax rate versus ordinary income taxes.

As you can imagine, the taxes on buying and selling collectibles can be complex. If you are considering selling a potentially valuable item, ask for assistance.

1 Source: IRS 2016 Schedule D instructions