If you are self employed and/or a Limited Liability Company with a single share holder and file a Schedule C, this is a must see video.

The Schedule C is the most heavily audited form by the IRS. 7% of all Schedule C’s for the self-employed are audited. Last year over 2.2 million people filed a Schedule C for 2012. So, over 158K people were audited on their tax return.

Why? Because the IRS did not believe them!

So, how can you prevent from being audited by the IRS?

In theory you just list all of your revenue and all of your expenses which gives you, your net income. Simple, Right!

Not everyone keeps accurate records and they end up guessing how much they made and how much they spent.

This is why you are watching this video by 1040Return.com. This video will give you tips on what the IRS is looking for when they audit a return.

First you have to realize that the IRS is not a bunch of idiots.

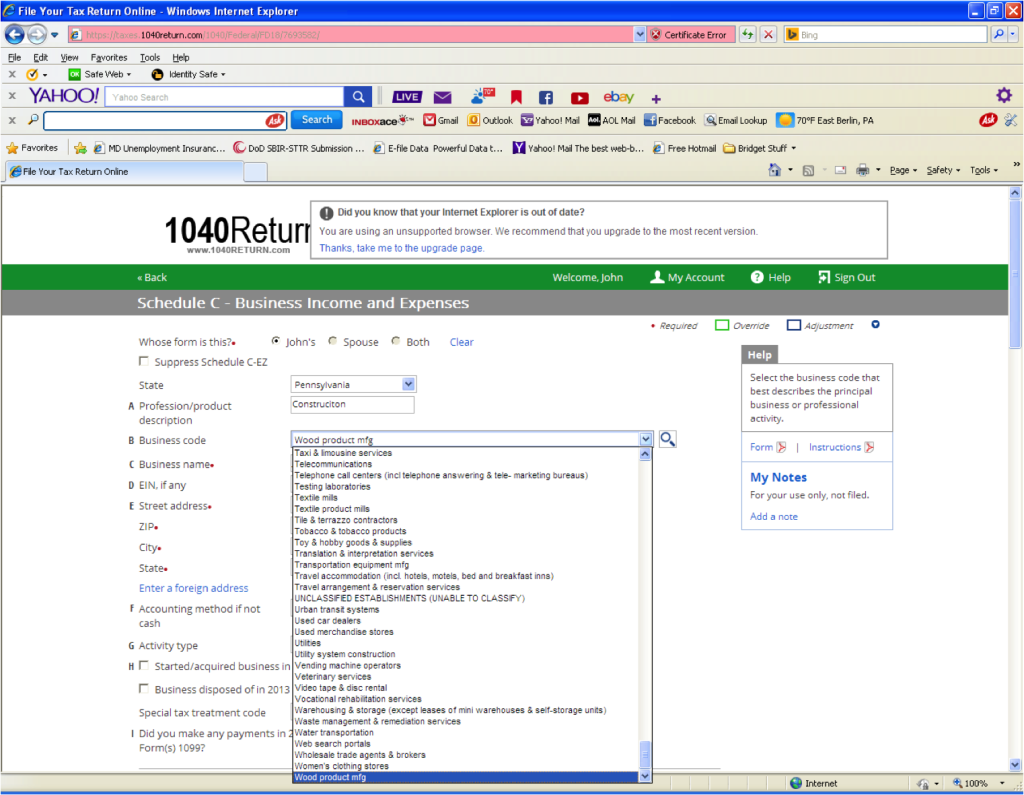

The most important item that you fill out on the Schedule C is the Standard Industrial Classification or better known as “SIC Code”. The SIC Code is the classification of your business. The IRS over time has developed a formula for each business classification on what they should be making as a net profit.

Within that net profit, the IRS will look for large swings in expenses and revenue. Obliviously, the IRS does not release that information. However, with a little common sense and help from 1040Return.com you can prevent from being a target of an audit by the IRS.

You can receive a FREE list of SIC codes and expected net profit from that industry at 1040Return.com. So, if you do not keep accurate records of your expenses and revenues at least you will have a guide on what the IRS expects you to report on your tax return.

OK, so let’s look at items that get people into trouble. First, let’s look at revenue.

If you work for someone and you earned more than $600.00 that individual is required by law to issue a 1099 for misc. income. They have until January 31st to send the the 1099 to the individual.

So, don’t file your schedule C until you have received all of your 1099s.

So, what happens if you file your tax return without all of your 1099s? You will get a letter from the IRS in about a year after you file your tax return. The letter is called a CP2000 for under reporting your income. Congratulations, you have just opened yourself up for an audit plus penalties and interest for not reporting all of your income. Most people think that once they receive their refund the coast is clear and they have nothing to fear.

Not true, it takes the IRS about 1 to 2 years to reconcile all of the 1099s on a tax return vs. what was reported to the IRS.

So, make sure you have all of your 1099s for income before you file.

OK, let’s talk about the elephant in the room – CASH!

So, you receive revenue from clients that pay you in cash. Remember, the IRS is not stupid and by going thru their formula from your SIC Code they have an idea of the percentage of revenue that will be generated from cash. So, if your business is a hair salon, the IRS expects you to claim a certain percentage of your revenue in cash with the balance being made up from credit card receipts.

Which brings me to my next point: Credit Card Transactions. If your business takes credit cards make sure at the end of the year you report all of your credit card transitions from your bank. Once again you’re Bank or Credit Card processor will send you a statement by January 31st showing how much revenue you received from Credit Cards. Make sure you report the gross amount and write off the cost of the credit card transactions fees as an expense on your schedule C.

If you do not have a bank account already for your business, get ONE! This will force you to write checks for your expenses which in turn will be proof that you paid for that expense. Get out of the habit of paying for your expenses with cash in your hand. Another easy way is to use your Bank Debit card to pay for your expenses. The Debit card is easy and is accepted anywhere where they take credit card. This way you have an accurate record of your expenses. Make sure you do make deposits into your business checking account to show your revenue. This way you can show proof of your revenue. When you need cash for your living expenses, write a check from your business account and deposit that check into your personal account. This is a record of your draw from the business.

These are simple things you can do on the revenue side of your IRS Schedule C.

OK, let’s talk about expenses.

Here are the items that are “hot buttons” with the IRS, and these points are audit flags on a IRS Schedule C.

Auto expenses and deductions for home office!

You have 2 choices for Auto Expenses. You can take the standard mileage or you can take the actual cost to operate your car plus the depreciation expense. Generally, you will always be better off taking the standard mileage rate unless you have an unusually high repair bills such as replacing a transmission or rebuilding an engine. The biggest problem with auto is taking the mileage deductions because people do not keep accurate records.

So, if you elect to take the standard mileage rate you should keep a log on your mileage. If you do not have a log and need log at the end of the video there will be a link where you can down load a log. So, if you didn’t keep a log throughout the year on your mileage. Now is a good time to reflect on how many miles you drove to perform your job. If you have a job that you go to consistently every day the best way is to Google the distance from your home to your job. Print out the distance and keep with your tax records. Also, you should have a Log Book and start making entries for every day that you drove to your work place. It is easier to do this now than 2 years from now and recreating a log. If you can’t find a 2014 log book from last year you can down load a FREE log book at 1040Return.com.

I think, I made this clear already, don’t just guess and say “I drove 10,000 miles” that will stick out like a sore thumb. Make an effort to get as close as possible to the correct number.

Also, when you are calculating your mileage for your business, remember once again some business will have a high mileage such as a traveling technician vs. someone who owns a day care businesses. Once again, your SIC number lets the IRS knows how much mileage one should have in a particular business. So, make sure your mileage make sense for your line of business.

The other hot button is home office deductions. This drives the IRS crazy and they have spent considerable amount of time in Tax Court on “what is a home office”? Generally, this is a room in your home that you use exclusively for business. However, there are so many exceptions that are too long to list in this video. Generally, if you can do without these expenses on your Schedule C you will be better off. The only exception that I would use the home office deductions is if you are running a day care out of your home. This is a common business practice and would not raise a red flag with the IRS. For a more detail explanation on what qualifies as a home office and how to calculate that expense you can go to 1040Return.com and it will take you to a more detail discussion on home office deductions.

Another reason so many IRS Schedule C ‘s are audited is because of the Earned Income Credit “EIC”. The EIC is a refundable credit for people who have children, which means that the government gives you money for working and supporting your children. You are considered the working poor and this is a subsidized by the government. The IRS estimates that the fraud Rate for EIC is between 25% to 30%. So, if you have a Schedule C and are claiming the EIC you are increasing your chance for an audit. The most likely outcome in this case, is that the IRS will denied you the EIC and force you to prove you support the dependents listed on your tax return. Should this happens you are required to submit documents showing that you provided the support for your dependents.

Another area that you have to watch out for is “Meals and Entertainment”.

You can write off your meals while you are conducting business.

You can also write off your expenses for taking clients out for meals and entertainment. You do have to talk about business and you do have to keep a log on the event. Once again if you do not have a meal and entertainment log you can download a FREE meals and entertainment log at 1040Return.com. You have to realize that the IRS has a reasonable idea on how much an individual should be writing off on their meals and entertainment. So, do not use this to write off your family vacation!

Here are the top ten items that you are not allowed to write off on Meals and Entertainment.

1 Club dues and membership including initiation fees

2 Country Club dues

3 Golf and athletic clubs dues

4 Airline Clubs dues

5 Hotel Clubs dues

6 You cannot deduct the rent from entertainment facilities such as rent for vacation home, swimming pool, tennis club, bowling alley, hunting lodge etc.

7 Skyboxes and other private luxury boxes. You can only write off what it would cost you to purchase a non luxury box and then you can only take 50% of that as a deduction..

8You generally cannot deduct the cost of entertainment for your spouse or for the spouse of a customer. However, you can deduct these costs if you can show you had a clear business purpose, rather than a personal or social purpose, for providing the entertainment

9 Taking turn paying for meals or entertainment. If a group of business acquaintances takes turns picking up each others’ meal or entertainment checks primarily for personal reasons, without regard to whether any business purposes are served, no member of the group can deduct any part of the expense.

10. Business is generally not considered to be the main purpose when business and entertainment are combined on hunting or fishing trips, or on yachts or other pleasure boats. Even if you show that business was the main purpose, you generally cannot deduct the expenses for the use of an entertainment facility

Lastly, the Affordable Health Care Act (ACHA), may impact your Schedule C. So, be sure to write off your insurance premiums on your Schedule C this is a valid deductions on your Schedule C.

In Summary if you do not keep accurate records, you should make reasonable estimates of your expenses and revenue to stay underneath the IRS radar. Remember, if your IRS Schedule C is audited you will lose every deduction that you are claiming if you do not have proof for that deductions.

Remember you can go to 1040Return.com to receive a FREE list of SIC codes and expected net profit from that industry. So, if you do not keep accurate records of your expenses and revenues at least you will have a guide on what the IRS expects you to report on your tax return.

The best software to use when you are doing your tax return is www.1040Return.com . The program is designed to ask you questions so you do not miss a deduction and www.1040Return.com helps prevent you from being audited by the IRS.

If you are ready to start completing your IRS Schedule C go to www.1040Return.com and try if for FREE.