There will be a lot of political rhetoric about increasing the national debt with trillions more in spending, adding billions to allow the IRS to audit high income taxpayers, and creating more changes in the tax code in the next few months.

To help you break through the media clutter, here is the latest information on who pays individual income taxes. The information comes directly from the IRS. It includes the latest published tax data for the 2018 tax year collected in 2019. It represents the first read on the impact of tax collections after implementation of the Tax Cuts and Jobs Act. While this time period is pre-COVID, it should give you an objective view of the current nature of the tax system without the impact of additional federal spending and the impact of unemployment due to the pandemic.

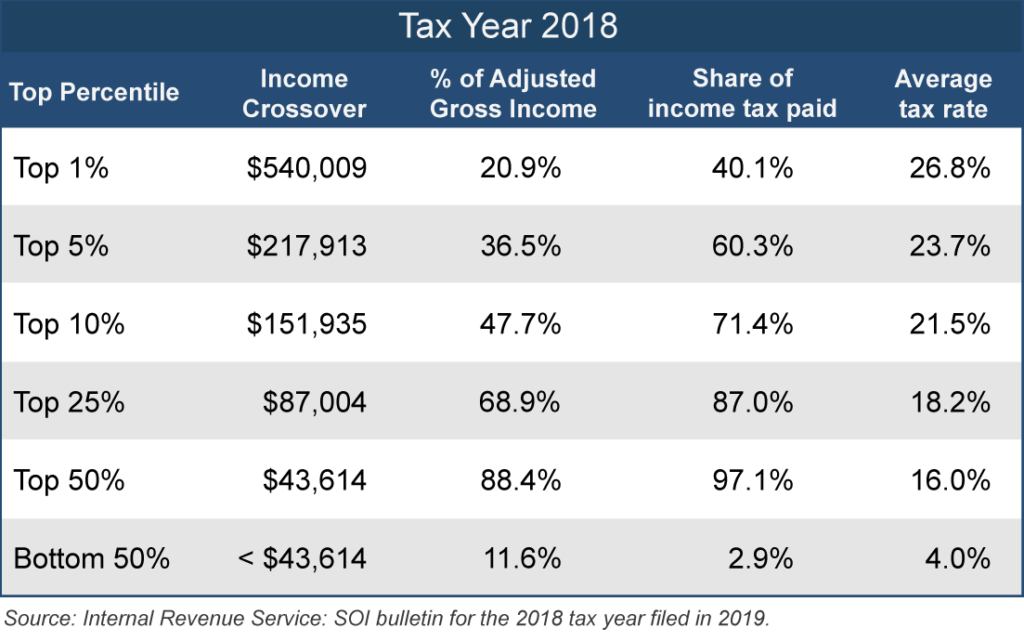

How to read: The top 10% of Adjusted Gross Income (AGI) taxpayers reported approximately 47.7% of the income and paid 71.4% of the total individual income tax collected in 2019 for 2018 tax returns.

Note: The above figures net out “negative” income tax returns for those who filed a tax return, but due to adjustments and credits have negative adjusted gross income.

Source: Internal Revenue Service, SOI Bulletin – Selected Income and Tax Items, Shares of Adjusted Gross Income and Total Income Tax and Average Tax Rates. All figures are based on estimates from sampling conducted by the Internal Revenue Service using 2019 tax filing data that encompass 2018 tax returns. Income means Adjusted Gross Income (AGI) as reported on individual income tax returns.

Observations

- The individual tax system is progressive. 97% of the taxes paid comes from 50% of the people filing tax returns.

- In 2001, per the IRS, the top 1% paid 33.2% of all income taxes. That number is now 40.1% in 2018. Over that same time period, the lowest 50% saw their tax burden decrease from 4.9% to 2.9%.

- Since over 70% of the income tax comes from 10% of taxpayers, you can understand how hiring more auditors to audit high income taxpayers may seem to make sense. It is the only place to get more revenue, since high income taxpayers are the ones paying most of the tax and the trend in rule changes is benefiting other taxpayer groups.

- The information above only include those required to file a tax return. If the data included all households, the percentage of income tax paid by households would weight payment of tax more highly toward the upper AGI households.

How to read the rhetoric

Everyone should pay their fair share. It is an interesting phrase, but what does it mean? How much, exactly, is a fair share for upper income groups? The top 25% currently pay 87% of the tax. Should it be 90%? 95%? All of it? Conversely, are they talking about the 50% of taxpayers that is paying 3% of total income taxes? You will need to decide, but when applying the IRS statistics, it seems like word speak without substance.

We have a progressive tax system. The IRS statistics noted above show this to be true. And even with the impact of the 2018 Tax Cuts and Jobs Act, the progressive nature of the system still holds true.

Tax cuts favor the wealthy. Yes, tax cuts favor the wealthy because that’s who currently pays the majority of income taxes. Tax increases also always hit higher income taxpayers…for the same reason. Part of the philosophical discussion surrounds the purpose of the income tax: is it to pay for spending or is it to redistribute wealth and convert income of some taxpayers into free and low cost benefits for others?

Higher income taxes hurt small business. This is true, but perhaps in more ways than you think. Most small business tax payments are rolled into these individual income tax numbers. This is because most small businesses have their business profits taxed on their personal tax return as flow through entities. So changes in individual tax rates impact most small businesses which in turn impacts their ability to invest in their businesses and employees. To help solve this problem, the tax code contains a tax break called the qualified business income deduction.