The IRS released new income tax withholding tables that reflect the changes to the tax bracket structure in the Tax Cuts and Jobs Act (TCJA) passed in late December. Employers will have until Feb. 15 to update their payroll systems to reflect the new changes, and employees will start seeing the changes in their paychecks after that point.

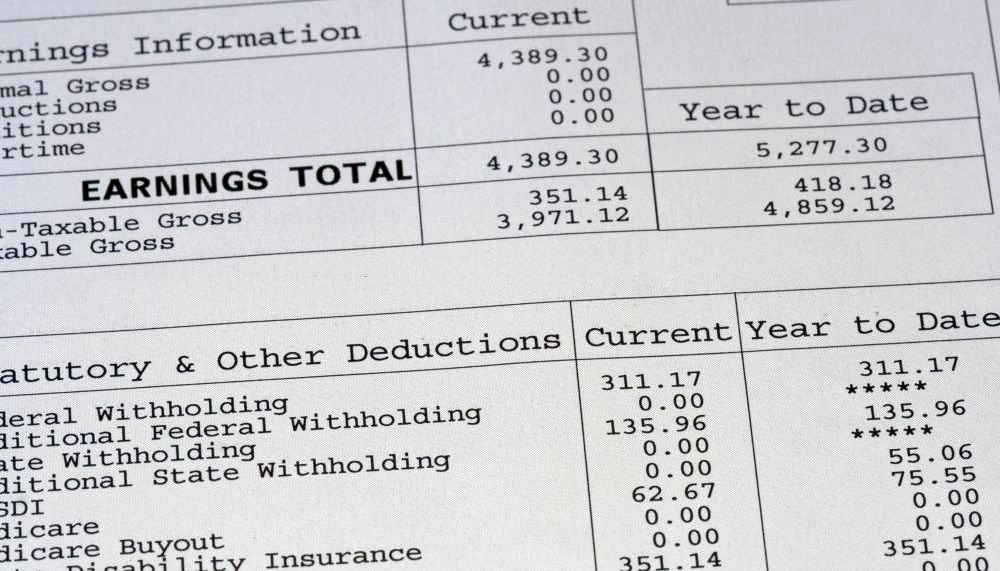

The TCJA reduces income tax rates for almost all taxpayers. Widespread tax changes like this seldom happen, so it’s worth keeping an eye on your pay stubs over the next few weeks. The danger is that if the changes aren’t done right, you’ll either have too much tax taken out every paycheck, or end up with a big tax bill because too little was withheld. Here are some tips:

Make sure the changes get done

If you are an employee, you’ll want to ensure that the withholding changes get done by Feb. 15. Most people will see their paychecks increase slightly. If there’s no change or change in the other direction, take a closer look and talk to your employer to find out why. These changes do not require you to file a new Form W-4 if you already have one on file with your employer.

If you are an employer, the IRS said in a notice that all employers “should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15.” The updated withholding tables are available on the IRS website.

Check the withholding calculator

By late February, the IRS said it will update its online withholding calculator tool.

Make a note to check this tool during early March to see whether your paychecks are correct. The tool will ask you to enter information including your income, tax status, and paycheck frequency. The calculator will come up with an estimate of what your paychecks should look like under the new tax laws.

Periodically double-check

What if your tax situation is more complex than the norm? You may end up under-withholding taxes from your paycheck even if things look okay earlier in the year. This is particularly true if you itemize your deductions, or have two or more jobs during the year. Compare your pay stubs with the withholding calculator again mid-year. That should still give you enough time to correct your situation if things have gone off track.

Sweeping tax law changes often trigger corresponding changes to employee withholdings. The 2018 changes created by the TCJA are no different. If you have any questions regarding your situation, don’t hesitate to call.